-

How to open an FBS account?

Click the ‘Open account’ button on our website and proceed to the Personal Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

-

How to start trading?

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

-

How to withdraw the money you earned with FBS?

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Personal Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

Parabolic SAR

Parabolic SAR is a powerful tool that helps to analyze trends. SAR stands for “Stop and Reverse”. It means that the indicator can not only determine a trend but also signal when it’s time to close a trend trade and look in the opposite direction. The indicator was developed by J. Welles Wilder, who is also known for creating such tools as ATR and RSI.

How to implement SAR

The Parabolic SAR is included in the default set of MetaTrader. You can add it to the chart by clicking “Insert” – “Indicators” – “Oscillators” and then choosing “Parabolic SAR”.

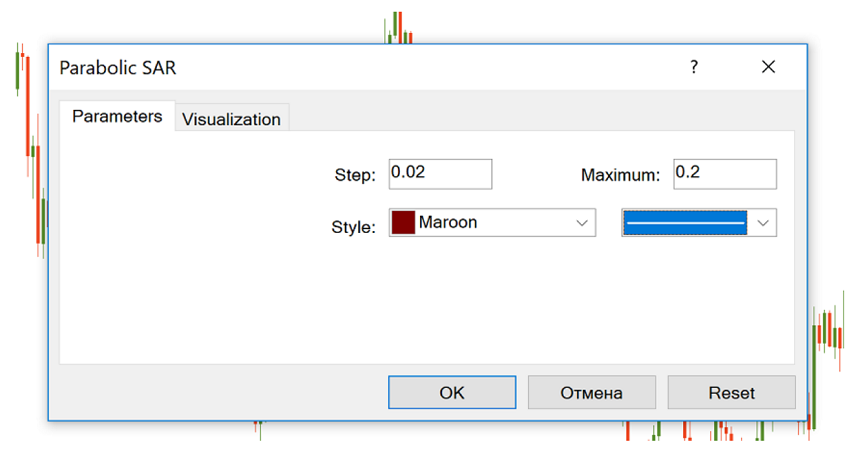

The indicator has 2 parameters you should set: “step“ and “maximum”. Their default values are 0.02 and 0.2. A step is the size of the acceleration factor. The acceleration factor starts with this value and then increases by the step size with each new high (or low for a downtrend), up to the value defined by the maximum parameter.

You can start with the default parameters of the indicator and then adjust them to the asset you trade, timeframes you use and your trading style. Depending on your choice the indicator can be more or less sensitive to the price. The higher the acceleration factor, the closer it will move to the price. However, you shouldn’t set it too high, as in this case there will be too many reversal signals. Wilder recommended not to set the maximum above 0.22.

How to interpret Parabolic SAR indicator

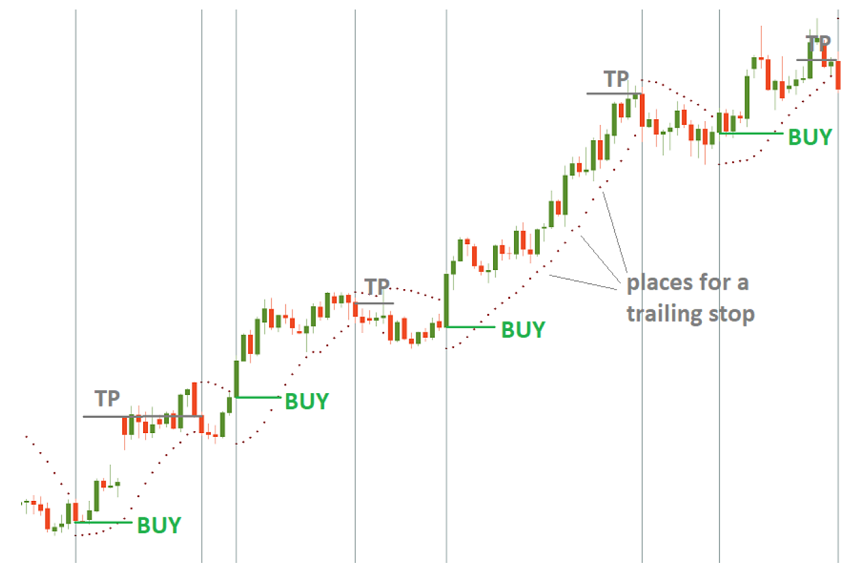

Parabolic is very simple to use. It is placing dots that define the trend. When the dots are below the price, the trend is bullish, while the dots above the price point at a bearish trend.

When the trend changes direction, parabolic gives an entry signal. It signals bearish reversal when it crosses the price to the upside and forms 3 descending dots above the candlesticks.

Parabolic signals bullish reversal when it crosses the price to the downside and forms 3 ascending dots below the candles.

The indicator offers great help in determining exit points. The solution is simple: you close a buy trade when the SAR returns above the price and close a sell trade when Parabolic gets back below the price. This way you hold open positions only in the direction of the indicator’s movement.

Moreover, Parabolic SAR provides a framework for trailing stops. In an uptrend, the indicator will rise following the surging prices. Move your Stop Loss order from one dot to the next in order to limit the risks and lock in profit.

Conclusion

The Parabolic SAR is a powerful and unique indicator. It works best in a trending market with long rallies and declines. In a sideways market, however, there is a high risk of getting false signals.

The SAR will work well in combination with other technical indicators, for example, ADX. If the ADX confirms the presence of a strong trend, you will be then able to use the Parabolic SAR with greater confidence.

2023-05-03 • Updated

Other articles in this section

- The McClellan Oscillator

- Aroon Indicator Trading Strategy

- Currency strength

- Moving Averages Ribbon: How to Find Entry Point

- Best Time Frames for Trading

- Renko charts Japanese candlestick chart

- Types of charts

- How to Use a Heikin-Ashi Chart?

- Quantitative Easing Policy (QE)

- Pivot Points

- What Is a ZigZag Indicator?

- Moving Average

- Williams’ Percent Range (%R)

- What Is Relative Vigor Index (RVI Indicator)?

- Momentum

- Force index

- What Is Envelopes Indicator?

- Bulls Power and Bears Power

- Average True Range

- How to trade on central bank decisions?

- CCI (Commodity Channel Index)

- Standard deviation

- Trading with Stochastic Oscillator

- Relative Strength Index

- MACD (Moving Average Convergence/Divergence)

- Oscillators

- ADX Indicator: How To Use It For Effective Forex Trend Analysis

- Bollinger bands

- Trend indicators

- Introduction to technical indicators

- Support and resistance

- Trend

- Technical analysis

- Central Banks: policy and effects

- Fundamental factors

- Fundamental Analysis in Forex and stock trading

- Fundamental vs technical analysis