-

How to open an FBS account?

Click the ‘Open account’ button on our website and proceed to the Personal Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

-

How to start trading?

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

-

How to withdraw the money you earned with FBS?

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Personal Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

Wolfe waves pattern

It’s time to upgrade your knowledge about the market even further by learning how to recognize a Wolfe waves pattern. This is an advanced chart pattern for experienced traders.

The idea that the market moves in a series of waves was developed by Ralph Nelson Elliott. Bill Wolfe proposed his own view on waves in technical analysis. The price in a Wolfe waves pattern is swinging like a pendulum trying to find equilibrium. Wolfe discovered a reversal pattern, so after trading within a channel during 4 waves, the price makes a breakout (leaves the channel) in the fifth wave.

You'll be pleased to know that a Wolfe waves pattern can be found on any time frame and at the chart of any financial instrument.

Bullish Wolfe waves pattern

There’s a very strict set of rules that define this pattern. Let's study a bullish Wolfe waves pattern first.

Here are its key parameters of bullish wolf pattern:

- Wave 1-2 is the base of the pattern and is bullish.

- Point 2 should be higher than point 1, while point 3 should be below point 1.

- Wave 3-4 should stay within the channel created by the wave 1-2. Waves 1-2 and 2-3 should be equal (symmetric). Point 3 is usually at the 127.2% or 161.8% extensions of the wave 1-2. Point 4 should be below point 2 and above point 3.

- Point 5 is the low set after the 3-4 wave. It’s located close to the line drawn through the points 1 and 3. Point 5 is usually at the 127.2% or 161.8% extensions of the wave 3-4.

- Point 6 lies at the line drawn from point 1 through point 4. Wave 5-6 is the longest wave of the pattern. Points 1, 4, and 6 lie at the one line.

How to trade

The idea of trading the bullish Wolfe waves pattern is to buy at the point 5. Take Profit order should be located at the point 6.

The point 5 can be at or below the 1-3 line. In this case, draw an auxiliary line through the points 2 and 4 and move this line in parallel to the point 3. The space between the line 1-3 and the projection of the line 2-4 from point 3 is called a "sweet zone". This is the are where you should look for the opportunity to buy. If the 2-4 line is parallel to the 1-3 line, then there’s no sweet zone. If the angle between the lines 1-3 and the projection of the line 2-4 is too, there’s a mistake and it’s not a Wolfe waves pattern. Check the example of a bullish Wolfe waves pattern in MetaTrader:

Bearish Wolfe waves pattern

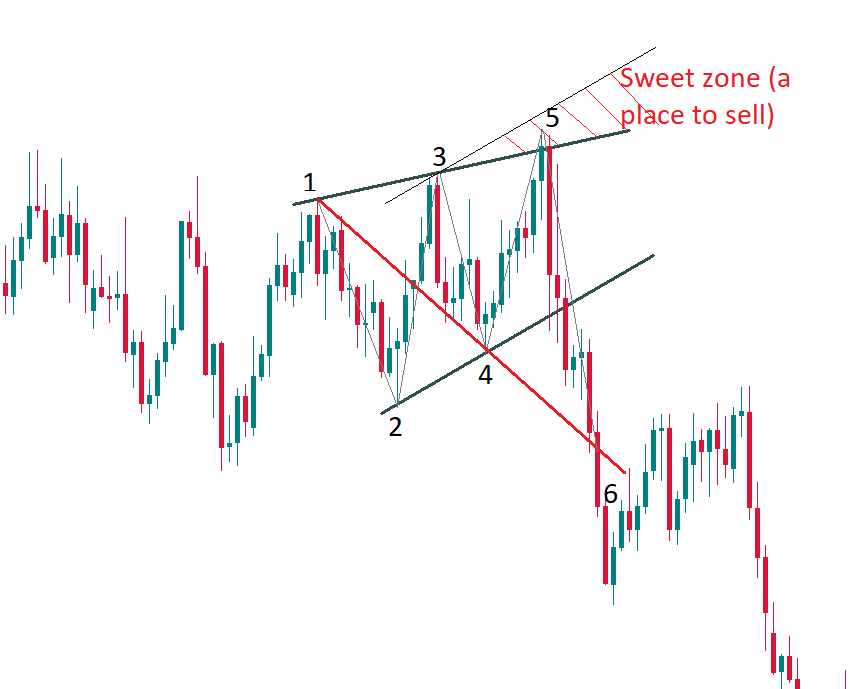

Now let's examine a bearish Wolfe waves pattern.

Here are its key parameters of bearish wolf pattern:

- Wave 1-2 is the base of the pattern and is bearish.

- Point 2 should be lower than point 1, while point 3 should be above point 1.

- Wave 3-4 should stay within the channel created by the wave 1-2. Waves 1-2 and 2-3 should be equal (symmetric). Point 3 is usually at the 127.2% or 161.8% extensions of the wave 1-2. Point 4 should be above point 2 and below point 3.

- Point 5 is the high set after the wave 3-4. It’s located close to the line drawn through the points 1 and 3. Point 5 is usually at the 127.2% or 161.8% extensions of the wave 3-4.

- Point 6 lies at the line drawn from point 1 through point 4. Wave 5-6 is the longest wave of the pattern. Points 1, 4, and 6 lie at the one line.

How to trade

Like the mirror of a bullish Wolfe waves pattern, the idea of trading the bearish Wolfe waves pattern is to sell at the point 5 (in the "sweet zone" for selling formed by drawing a line parallel to the line 2-4 from point 3). Take Profit order should be located at the point 6. Here's how such trade looks on a real chart:

Conclusion

To find a Wolfe waves pattern on the chart, look for 3 points that lie at about one line. Check for points 2 and 4 nearby and see whether it all fits the description of a bullish or bearish pattern.

We recommend trading Wolfe waves patterns for those who already have some Forex trading experience because it's not easy to recognize these setups on the charts. However, once recognized, the pattern generates a signal that offers a very high probability of successful trade, so if you master it, you'll have some spectacular trades.

2022-04-04 • Updated

Other articles in this section

- Structure of a Trading Robot

- Building a Trading Robot without Programming

- How to Launch Trading Robots in MetaTrader 5?

- Algorithmic Trading: What Is It?

- Fibonacci Ratios and Impulse Waves

- Guidelines of Alternation

- What is a triangle?

- Double Three and Triple Three patterns

- Double Zigzag

- Zig Zag and Flat Patterns in Trading

- Advanced techniques of position sizing

- Truncation in the Elliott Wave Theory

- Ichimoku

- What is an extension?

- Ending Diagonal Pattern

- How to trade gaps

- Leading diagonal pattern

- Three drives pattern

- Shark

- Butterfly

- Crab Pattern

- Bat

- Gartley

- ABCD Pattern

- Harmonic patterns

- What is an impulse wave?

- Motive and corrective waves. Wave degrees

- Introduction to the Elliott Wave Theory

- How to trade breakouts

- Trading Forex news

- How to place a Take Profit order?

- Risk management

- How to place a Stop Loss order?

- Technical indicators: trading divergences