Struggling to choose between part-time and full-time trading? Then this article is for you!

2023-02-03 • Updated

One of the principles of technical analysis is that price moves in trends. Every trend consists of periods when the price moves in the direction of this trend and smaller periods of counter trend corrections.

Trend following strategies imply that a trader opens a position in the direction of the main trend. In other words, they buy in an uptrend and sell in a downtrend. The best time for entering the market using this approach is when a correction ends and the main trend resumes. “Buy low and sell high” is traders’ favorite mantra.

Counter-trend traders don’t want to wait for a correction to pass. If the market is in an uptrend, they can sell when the price reverses from resistance and set a target near support. Their motivation is that the price has already gone too high so that it’s bound to decline, at least for some time.

Do these approaches have similar risks or not? Which one can offer traders greater profit? Let’s discuss.

Trend trading is an attempt to profit by analyzing the momentum of an asset in a particular direction. When the price moves in one general direction, such as up or down, it’s called a trend.

Trend traders go long when an asset is trending up. Higher swing lows and higher swing highs characterize an uptrend. Similarly, trend traders can enter a short position when an asset moves down. Lower-swing lows and lower-swing highs characterize a downtrend.

Trend trading strategies assume that an asset will continue to move in the same direction it is currently in. Such strategies often contain Take Profit or Stop Loss provisions to lock in profits or avoid large losses in the event of a trend reversal. Trend trading is used by short-, medium- and long-term traders.

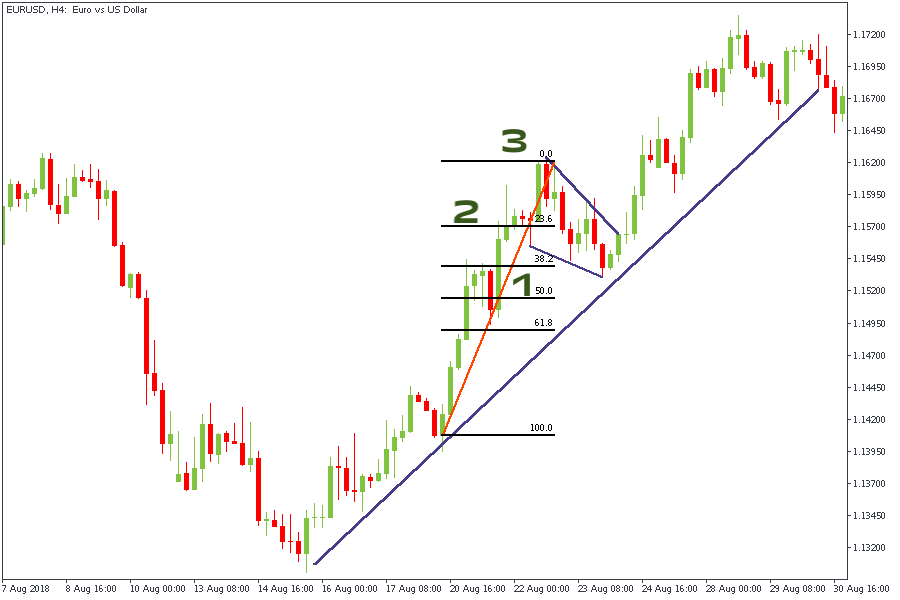

Most traders can determine the current trend. The tricky part is to decide how to act. Let’s continue with the uptrend example. Trend trading implies that you will either buy at support or on the break of resistance. In the first case, you will use such instruments as trendlines and Fibonacci retracements. In the second case, you can use continuation chart patterns like triangles, flags, and wedges.

Some traders will buy at the point 1 (trendline support and Fibonacci retracement level) or 2 (a break of a “Flag” pattern), some will wait for the point 3 (a break above the previous high). Of course, the lower you buy, the bigger your profit can be.

You can set your profit target at the previous high of the uptrend (low of the downtrend) or even levels beyond it if you are more confident in your trade.

Notice that when you ride a trend, you can use a trailing stop that follows the trend. Be aware, however, that it may be not very easy to decide where to move a Stop Loss. The risk will be that a dipper correction will make the market hit your stop and close your order.

It’s allowed to add to a position when you follow a trend if the market already moved in your favor and your trade became profitable. This way your potential profit will increase. Don’t forget to adjust your risk management if you do this. You can also plan to start with a smaller trade than usual (for example, buy at the point 1) and then increase it when the price gets above point 2. This tactic will reduce your risk.

A counter trend is a correction in the price of an asset against the main trend. Simply saying, when the market is in an uptrend and pulls back, the pullback to the downside is a counter trend because it goes against the original market trend.

A counter trend trading strategy is an attempt to make a small profit by opening trade against the main trend. Counter trend trading is a form of swing trading that assumes that the current market trend will experience reversals or pullbacks and then attempts to profit from the pullback as the underlying trend continues. This strategy is medium-term, where positions are held for a few days or a few weeks.

Some traders who use this strategy for profit use pullbacks while maintaining their main positions in the direction of the trend. Countertrend strategies use momentum indicators, support and resistance levels, and candlestick patterns to identify possible market entry points. However, it is necessary that traders using this method be careful to resume the current trend at any time without warning. Thus, when trading with this strategy, proper risk management techniques such as Stop Loss orders and minimum position sizes should be used to limit losses.

Traders using this approach take hints from reversal candlestick patterns (pin bars, evening/morning starts, etc.). They also apply oscillators like MACD or RSI to see whether the market has become overbought/oversold and whether there’s a divergence between the price and the indicator. If these signs are present, traders open positions counter the previous trend.

A trader may decide to sell at the point 1 as the price formed a candlestick with a long upper shadow (a negative sign) and the MACD indicator didn’t confirm the price’s high.

It’s harder to find a place to fix profit when you trade counter trend. The challenge is not to get too greedy. Remember that you bet against the market. Some trends can turn into a sideways market limiting profit of a counter trend position. The initial trend can also resume fast and not let the price correct too much. As a result, be careful and manage the risks.

The location for a Stop Loss order in such a trade is natural. Traders put their Stop Losses behind the extreme point of the price from which a correction has started. The Stop Loss will likely be smaller than the one you would use if you traded the trend.

It’s not a good idea to meddle with your position size when you trade counter trend. The trade can be very short-term, so you risk getting yourself in an uncomfortable situation if you try to add to a trade. And never add to a losing position as it may lead to a bigger loss.

In our new video, we’ll discuss trend trading and counter trading more precisely.

As you can see, both trading approaches have their specific traits. Both can generate good trade signals, but each requires its own risk management strategy. The common wisdom of traders is that counter trend trading requires much more experience and beginners should start with trend following. Practice and see which way works for you!

Struggling to choose between part-time and full-time trading? Then this article is for you!

A triangle chart pattern is a consolidation pattern that involves an asset price moving within a gradually narrowing range.

The Cypher pattern isn’t the most famous trading formation. Nevertheless, this trading instrument can help you better understand and forecast the price moves.

Click the ‘Open account’ button on our website and proceed to the Personal Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Personal Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!