How Trading Conditions Can Affect a Trader’s Performance

Trading Conditions

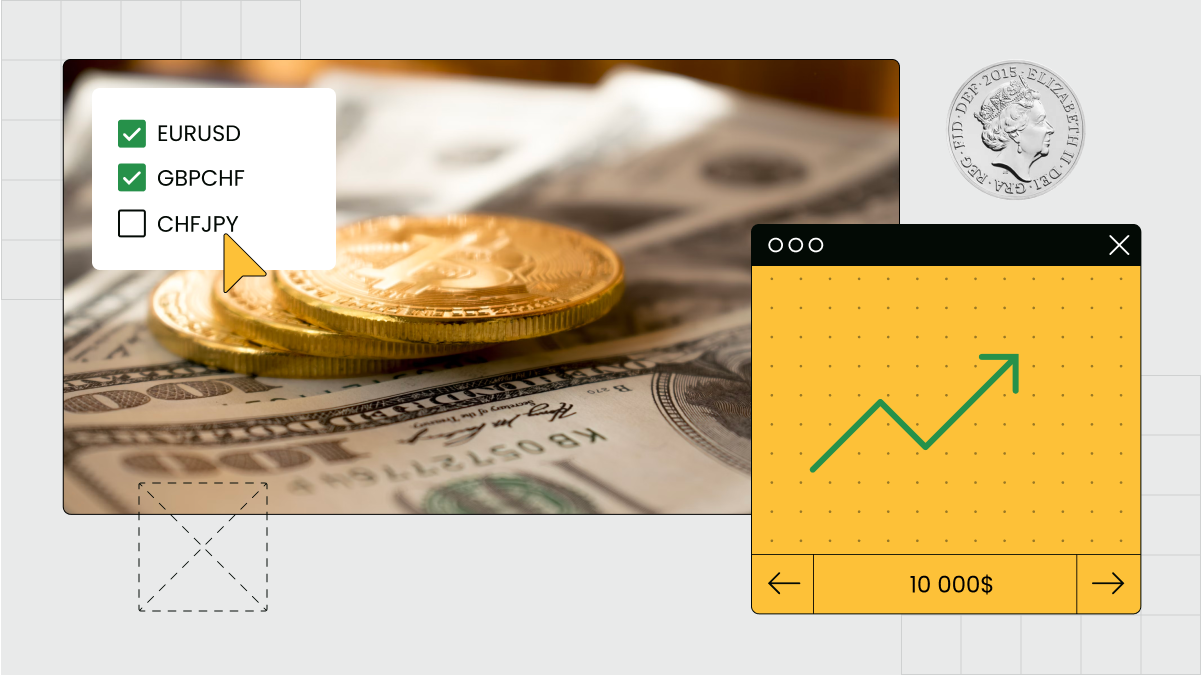

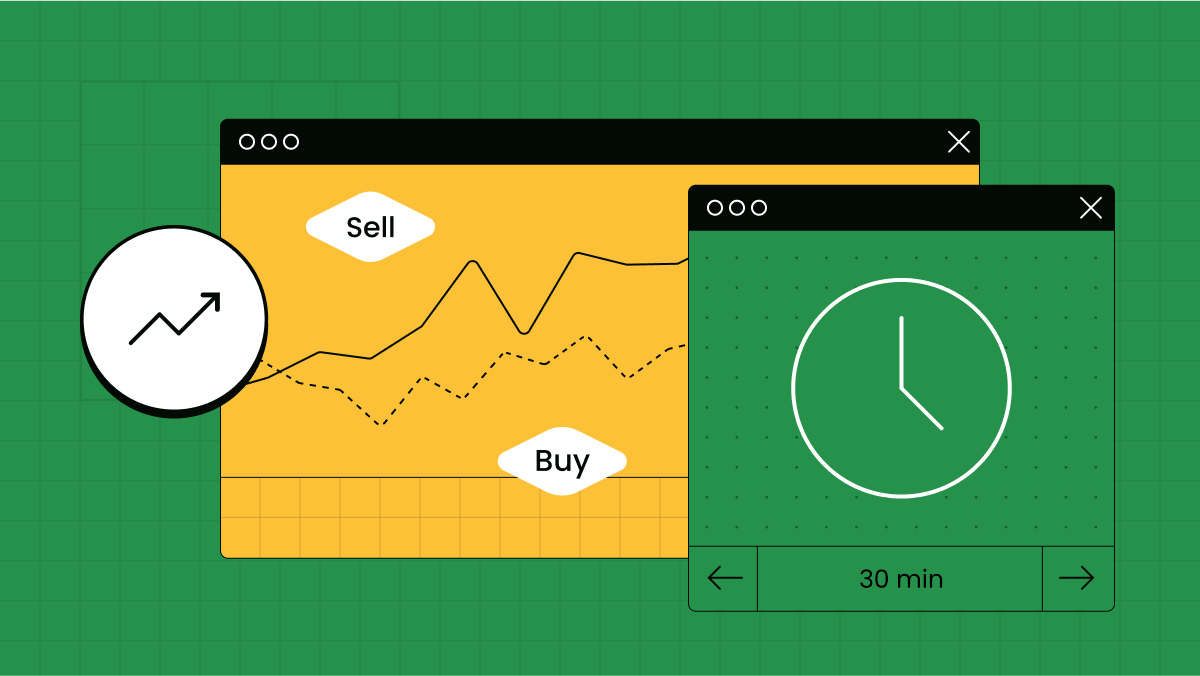

As traders step into the world of Forex trading, they enter a realm defined by constant change and unpredictability in market conditions. From volatile markets to calm waters, each condition presents unique challenges and opportunities for traders. Understanding how these conditions impact trading performance is crucial for anyone looking to excel in the Forex market. In this article, we will delve into the significance of trading conditions, explore different strategies to optimize performance, and shed light on the importance of selecting the right Forex broker.