July is right around the corner, and it heralds the start of the year's second half. In this article, I hope to share with you, my dear readers, a few of my trade ideas for July in hopes that it fetches you all some sizable profits and makes your July fun and fruitful. Let’s go!

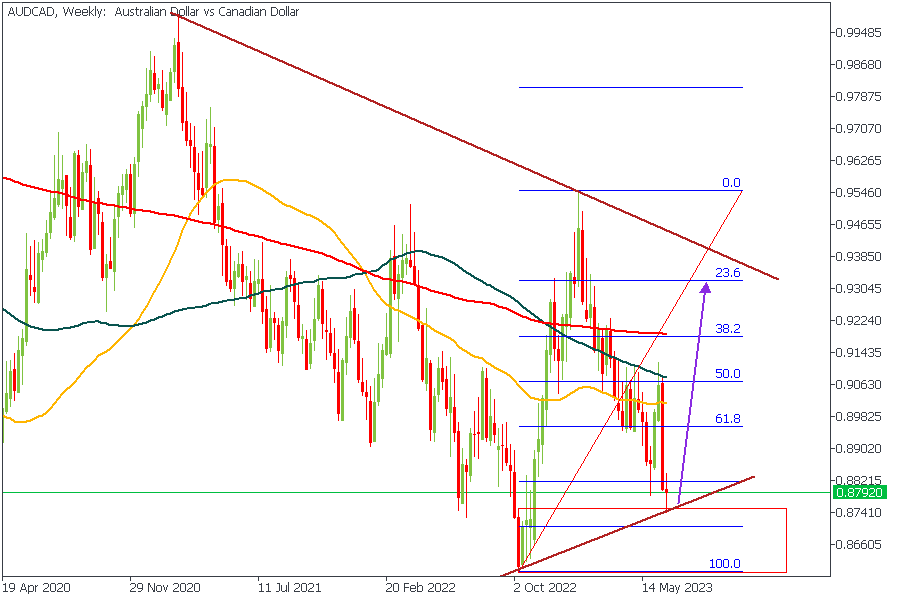

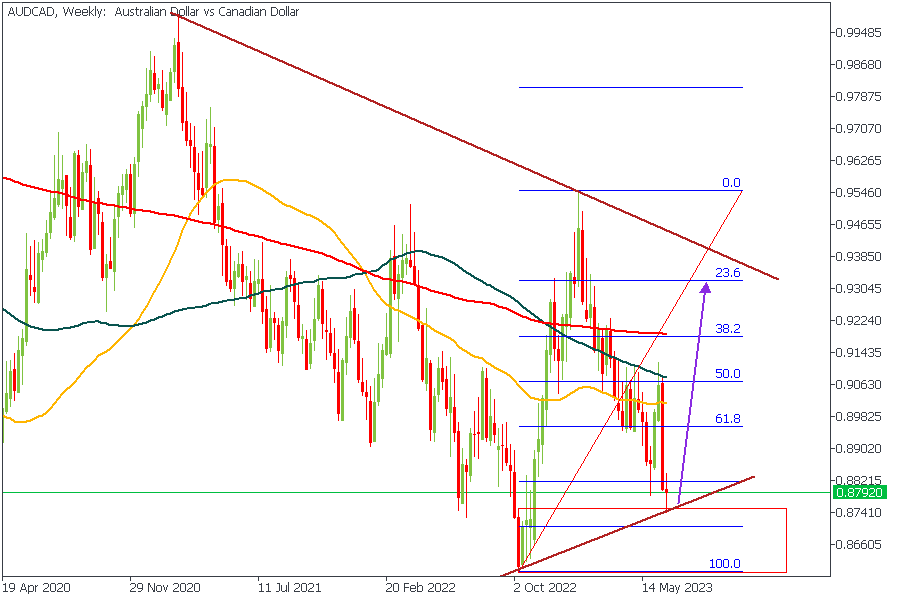

AUDCAD - W1 Timeframe

Let’s take a look at AUDCAD first of all. Here we see the wick of the current weekly candle resting on top of a trendline support that cuts across the drop-base-rally demand zone. Also, there is a clear break above the previous structural high, with a retest at 76% of the Fibonacci retracement zone. In line with these criteria, I would expect to see AUDCAD get rejected from the demand zone with a bullish price action extending to the 38% region of the Fibonacci retracement.

Analyst’s Expectations:

Direction: Bullish

Target: 0.91267

Invalidation: 0.86010

USDCAD - W1 Timeframe

The price action on USDCAD appears pretty obvious. We can see a rally-base-rally demand zone that aligns with the 200 and 100 period moving averages as support and 76% of the Fibonacci retracement. In this scenario, I expect USDCAD to rise to 24% of the Fibonacci retracement since we also have a trendline support as an added confluence in favor of a bullish rebound.

Analyst’s Expectations:

Direction: Bullish

Target: 1.35727

Invalidation: 1.30139

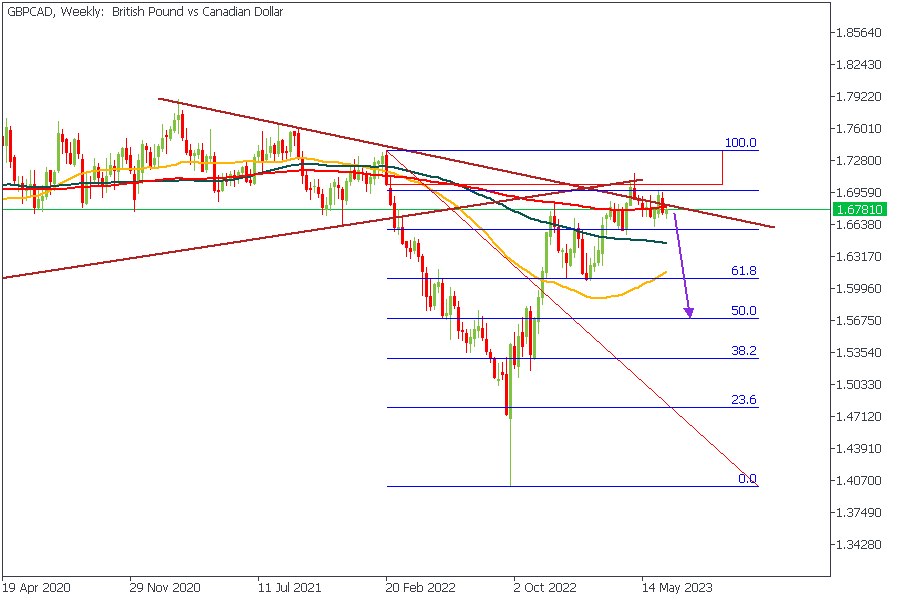

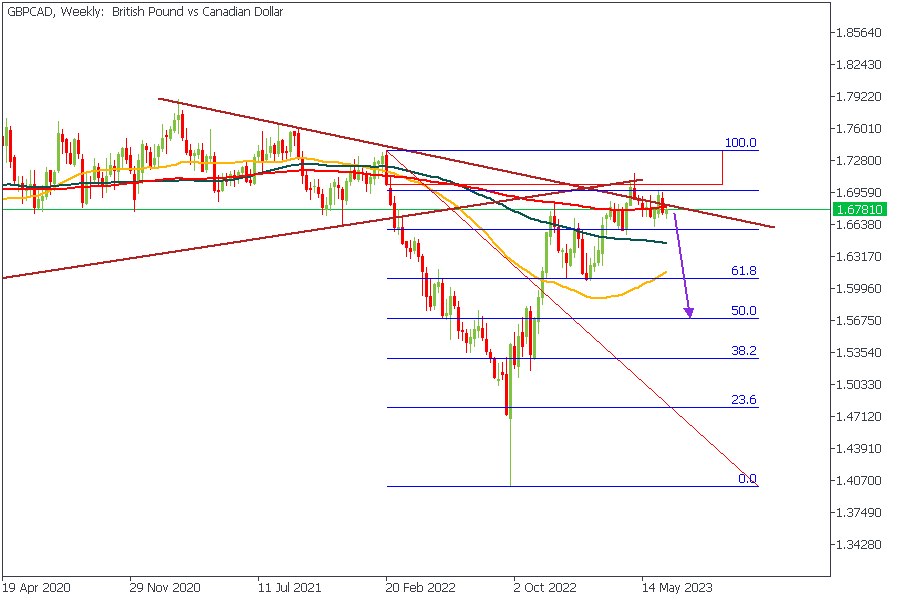

GBPCAD - W1 Timeframe

GBPCAD presents another interesting setup. In this case, we even see price trading at an intersection of two resistance trendlines - one of my favorite confluences for trend continuation trades. In addition to these, we also have a rally-base-drop supply zone, a 200-period moving average resistance, and the 88% Fibonacci retracement level as resistance. Did you notice the moving averages? They are also arrayed in a clear bearish order, meaning we have at least five confluences in favor of a bearish outcome on GBPCAD.

Analyst’s Expectations:

Direction: Bearish

Target: 1.58063

Invalidation: 1.70099

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

TRY TRADING NOW

You can access more of such trade ideas and prompt market updates on the telegram channel.