A triangle chart pattern is a consolidation pattern that involves an asset price moving within a gradually narrowing range.

2023-04-03 • Updated

In technical analysis, there are different chart patterns that help you to determine the further direction for the price. In the broadest sense, all of these patterns are divided into two large groups: reversal and continuation chart patterns. You can learn how to define them in our Forex Guidebook. Today, we will present to you the trading strategy for one of the most commonly known patterns. Of course, we are talking about the Head and shoulders pattern.

What comes to your mind when you hear the words “head and shoulders”? If it is the smell of your favorite shampoo, then you don’t trade hard enough! The first thing which comes to the mind of a professional trader is, of course, the famous reversal pattern.

The head and shoulders pattern usually occurs at the end of the uptrend. You can easily spot it on any timeframe. It is formed by a peak (first shoulder), a higher peak (head), and a lower peak (second shoulder). You can draw a “neckline” by connecting the minimums of the left shoulder and the head. The neckline shouldn’t be horizontal. Its slope may either be up or down. When the slope is down, the pattern provides a more reliable sell signal.

If you trade during the downtrend, you need to look for the inverse Head and shoulders pattern on the chart. This pattern is exactly opposite to the classic Head and shoulders pattern and may signal a bullish reversal.

There are several strategies to trade the Heads and Shoulders pattern. We will introduce you the easiest ones. The strategies listed below are universal: they may be applied to any currency pair, stock or commodity on any timeframe and they do not require additional indicators.

Let’s look at the 4-hour chart for USD/JPY. We can see, that the Head and shoulders pattern was implemented.

Bulls could not hold the price at the highs at 114.54 and the pair fell below the neckline at 113.56. We opened a sell order after the break of the neckline, 5 pips below it at 113.51. We set our stop loss 5 pips above the neckline at 113.66. Then we counted the level of our take profit using the following formula:

114.54 (the top of the “head”) – 113.56 (the neckline) = 0.98

113.640-0.98=112.66

Success! You’ve earned around 100 pips!

You can use this strategy for the inverse Head and Shoulders, too. Here are the steps:

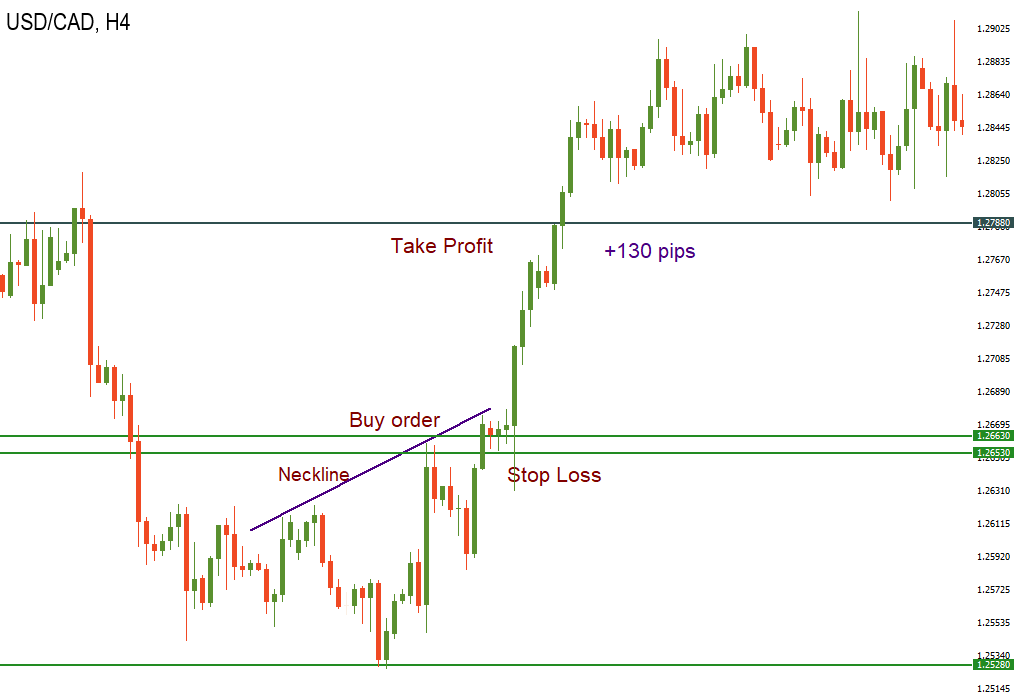

On the H4 chart of USD/CAD, we can see the Head and shoulders pattern. We see, that the neckline is not so perfect, but its slope goes up, which means the reversal is likely to happen.

We place a stop loss at 1.2653 and wait for the breakout of the neckline. When the candlestick is formed, we open a long order at 1.2663. We count our take profit:

1.2658 (the neckline) - 1.2528 (the head) = 0.0130

1.2658+0.013=1.2788.

Using this strategy, you earned 130 pips.

The Head and shoulders pattern is noticeable on the chart and provides a good opportunity for profitable trading with limited risks.

A triangle chart pattern is a consolidation pattern that involves an asset price moving within a gradually narrowing range.

Sometimes a chart or a candlestick pattern may provide a decent entry signal if it is located at a certain level. A pin bar is one of the most reliable and famous candlestick patterns, and when traders see it on the chart, they expect the price to change its direction soon.

Doji candles are rare birds, but if you catch them, it can be a great chance to seize the right entry moment. This article will discuss what a Doji candle is. You will also get a Doji strategy that can bring profit.

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

Click the 'Open account' button on our website and proceed to the Trader Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Trader Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!