-

How to start trading?

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

-

How to open an FBS account?

Click the 'Open account' button on our website and proceed to the Trader Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

-

How to withdraw the money you earned with FBS?

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Trader Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

What is a triangle?

Triangles are a correction five-wave pattern (marked as A-B-C-D-E), which is divided into five types. This pattern is formed in a position prior to the final wave in an impulse or a correction. For example, a triangle could be formed in a wave four in an impulse or wave B in a zigzag.

Also, this pattern occurs in final wave X in a double/triple zigzag or three patterns.

- Wave two of an impulse can’t be a triangle.

- Waves A, B and C are usually zigzags, double zigzags, triple zigzags (that’s rare), double and triple threes.

- Waves D and E could be triangles themselves.

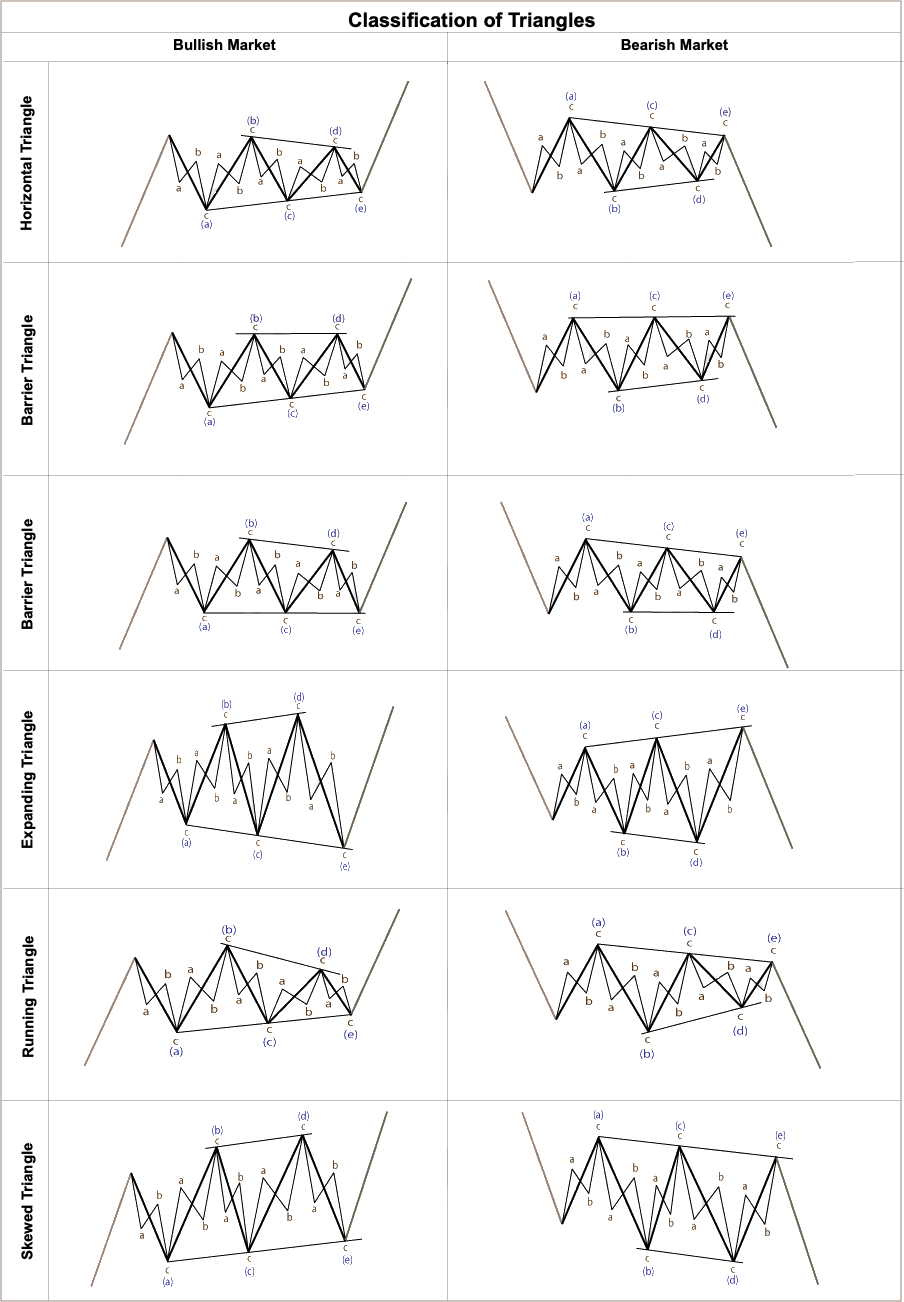

Triangle’s classification

On the next picture, you can find all types of triangles (Horizontal, Barrier, Expanding, Running and Skewed). Let’s examine them one by one.

Horizontal Triangle

This pattern is also known as a contracting triangle. As you might guess from the name of this pattern, its lines are aimed towards each other. Each wave of this triangle is shorter than the previous one, which means wave (b) doesn’t break the beginning point of the wave (a), wave (c) doesn’t break the starting point of the wave (b) etc. On the next chart, you can see a triangle in the position of the fourth wave, so a five-wave decline happened right after the pattern.

Barrier Triangle

The only difference from the contracting triangle is that the line B-D or A-C-E is horizontal. The other one goes towards a horizontal line, so a Barrier Triangle is a variation of the contracting pattern. You can find an example of this pattern on the chart below.

Expanding Triangle

This triangle is the trickiest one. It’s simply impossible to predict this pattern from the beginning, so we could count it only when the wave E finishes. Both lines of the pattern are directed in the opposite direction.

Running Triangle

Sometimes, the wave B of a triangle could be longer than wave A, but all other waves are smaller from the one before. The next chart shows an example of a Running Triangle in the position of the fourth wave. As you can see, wave ((e)) of the pattern doesn’t reach the upper side of the triangle. This happens quite often, so we should always consider the structure of the wave E to predict its ending.

Skewed Triangle

If a very strong trend takes place, we could face a Skewed Triangle, its wave D is longer than wave B. So. It’s the only type of triangle, which has a direction towards the main trend. This pattern is rare and we should mark it as the last possible scenario. The following chart represents a Skewed Triangle, which pushed the price higher into the fifth wave.

Other examples: Ending of wave E

It’s possible for the wave E to break the A-C line of a triangle. If this happens, it’s important to wait for the price to come back into a range of the pattern. As you can see on the chart below, the pair tested the triangle’s lower side, but a subsequent pullback from it led to the beginning of the fifth wave.

Massive fifth wave

From time to time, the market could move pretty fast right after a triangle. The next chart shows that case. The ending of the wave ((iv)) as a triangle turned out to a huge rally in wave ((v)). As far as we know that a triangle forms prior to the final wave in an impulse, we should expect a correction after the rally. Note that there’s also a small triangle in wave (iv) of ((iii)).

Two triangles

If an extension in the third wave takes place, it’s possible to wave two triangles in a row, which could be formed in a position of the fourth waves from different degrees. You can find an example of such a case on the last chart. Wave 4 of (3) is formed as a triangle, but right after the wave 5 of (3) the market developed another triangle in wave (4).

The Bottom Line

There’re a few deferent shapes of triangles. This pattern is the last correction in impulsive or corrective structures. We could count a triangle only when its structure is fully completed.

2023-07-26 • Updated

Other articles in this section

- Structure of a Trading Robot

- Building a Trading Robot without Programming

- How to Launch Trading Robots in MetaTrader 5?

- Algorithmic Trading: What Is It?

- Fibonacci Ratios and Impulse Waves

- Guidelines of Alternation

- Double Three and Triple Three patterns

- Double Zigzag

- Zig Zag and Flat Patterns in Trading

- Advanced techniques of position sizing

- Truncation in the Elliott Wave Theory

- Ichimoku

- What is an extension?

- Ending Diagonal Pattern

- How to trade gaps

- Leading diagonal pattern

- Wolfe waves pattern

- Three drives pattern

- Shark

- Butterfly

- Crab Pattern

- Bat

- Gartley

- ABCD Pattern

- Harmonic patterns

- What is an impulse wave?

- Motive and corrective waves. Wave degrees

- Introduction to the Elliott Wave Theory

- How to trade breakouts

- Trading Forex news

- How to place a Take Profit order?

- Risk management

- How to place a Stop Loss order?

- Technical indicators: trading divergences